A Non Participating Whole Life Insurance Policy Was Surrendered

Sergeinik 125 1 year ago. This windfall was seen several years back when Sun Life Manulife and Canada life.

Life Insurance Introduction Of Life Insurance In Hk

Many whole-of-life policies offer a conversion option.

A non participating whole life insurance policy was surrendered. After paying your premiums for 10 years you find there is 10000 cash value on your policy. We are talking about loans in their hundreds of millions. However many times than not you want to give up your policy before its stipulated tenure.

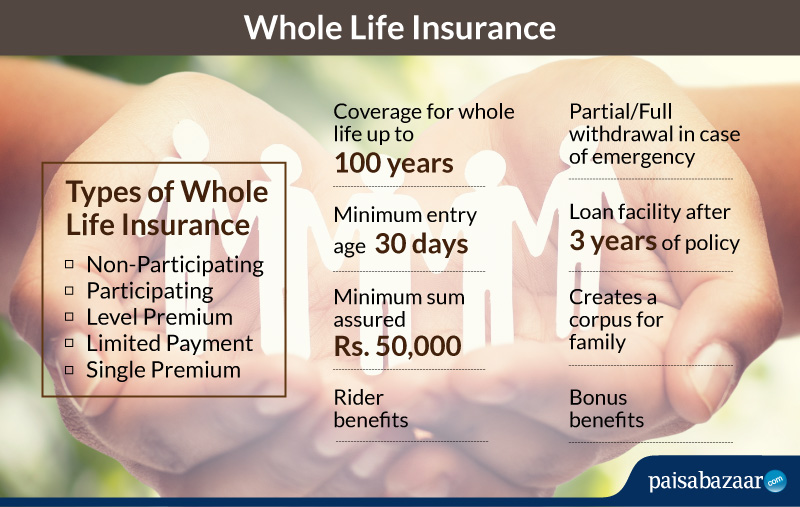

An extended term insurance refers to a non-forfeiture option which is given by life insurance companies to those policy holders that holds whole life insurance policy. Surrendering is common for whole life insurance policies which accrue cash value over time. It is available in different forms such as participating and non-participating policies.

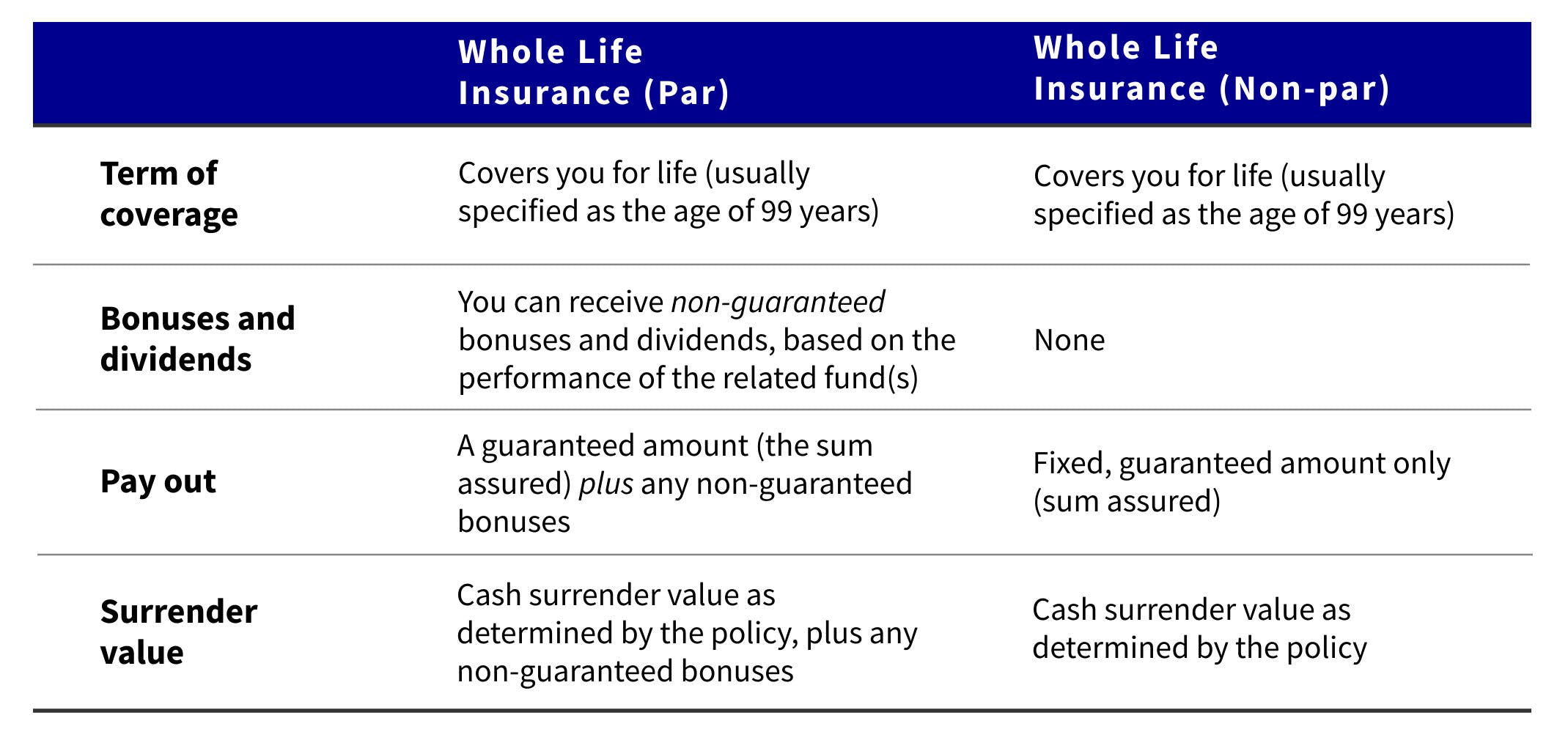

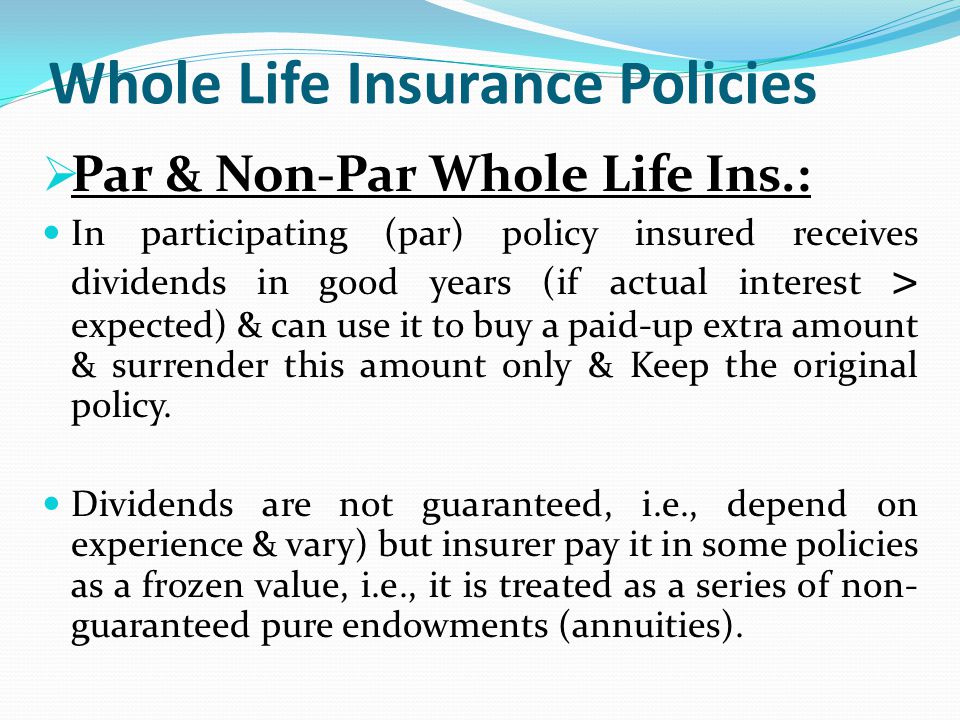

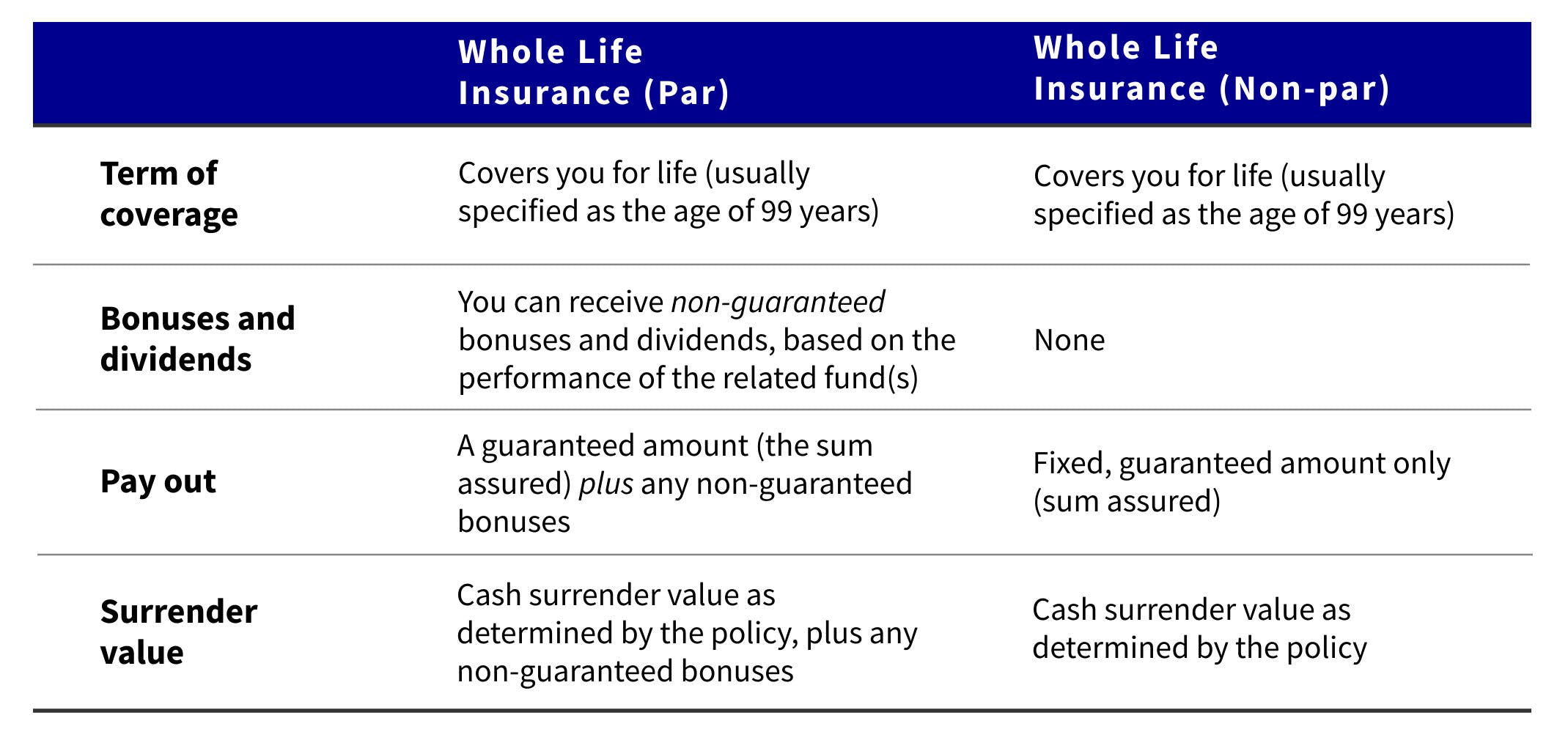

Non-parcipitating whole life insurance is insurance under which the insured is not entitled to share in the divisible surplus of the company. The better the company you bought does then the more they will share with you. Dividend rates can fluctuate from year to year and there is no guarantee that the company will pay a dividend in a.

The wording of the letter was fuzzy but the way the insurance compnay filled out the form 1099-R was not. You buy the policy with a term ranging anywhere from 5 years to 35 years. Banks spread the risk among several financial institutions so that the non-performance of the loan does not lead to the collapse of any one financial institution.

HMRC IPTM 3310 further states that in general chargeable events only occur in restricted circumstances and then lists them - none of which apply. One of the most important aspects to consider is getting a. What were the federal income tax consequences to the policyowner on receipt of the cash value.

Most participating whole life policies. You will receive a dividend that helps the policy grow. Participating whole life insurance policies do generate an annual dividend.

In insurance a participating fund is a fund that pays dividends to the policy. Participating means that you participate in the performance of the company. June 24 2021.

There is no such thing as a participating loan or a non-participating loan for whole life insurance policies. Almost all policies have a surrender charge which can be as high as 35 or more depending on the elapsed period of time since the policy was taken out. For example if you have purchased a life insurance plan for ten years but if you want to end the plan avail the benefits after five years the proceeds you get on surrendering the policy.

HMRC helpsheet 320 states that there is generally no tax to pay on the surrender of a qualifying policy. Whole life insurance provides life-long protection. Non-participating whole life policies provide lifetime protection fixed premiums guaranteed cash values and certain plans can be paid-up in a limited number of years.

People who no longer need their life insurance policy or who have immediate financial needs should consider surrendering it. What Does It Mean to Surrender A Life Insurance Policy. This means the policy can be paid out at the end of the specified period or on death whichever is.

A life insurance policy is a long term contract. Everything is set when a non-participating policy is taken out and nothing can be changed. A nonparticipating whole life insurance policy was surrendered for its 20000 cash value.

Although this may initially sound like bad news it is not necessarily. Non-participating whole life insurance policies do not generate an annual dividend for its policy holders. When you surrender your life insurance policy you essentially cancel it.

Surrendering a life insurance policy means giving up the plan before the end of actual tenure and redeeming the accrued benefits as on the date of surrender. But if you still need a life insurance policy and you dont have a replacement policy lined up you should not surrender it. Not only it helps grow the cash value but also the death benefit.

The letter I got from the insurance company when I surrendered my policy said that the transaction I requested ie surrendering my policy could result in it becoming a MEC and that if it turned it into a MEC the additional 10 tax penalty would apply since I was less than age 59-12. When a whole life policy is surrendered for its nonforfeiture value what is the automatic option. Your share of the profit is paid in the form of bonuses or dividends to your policy.

Depending on the circumstances surrendering your life insurance policy can be helpful. By surrendering you agree to take the cash surrender value which is assigned by your insurance provider while also forgoing the death benefit. Participating Whole Life Insurance.

Death benefits premiums and cash surrender values are all determined when the policy is purchased. The automatic option is extended term. Non Participating whole life insurance is NOT owned by mutual insurers and typical policies DO not receive policy dividends.

As an example suppose you take out a whole of life insurance policy with your provider with a payout of 200000 upon your death. The annual dividend allows the insured to share in the profitability of the insurance company. The policy is intangible and pays a benefit either in case of maturity or death during the term of the plan.

The total premiums paid had totaled 16000. One additional benefit of participating whole life insurance policies is that insurance companies that are also mutual companies who demutualize in the future to raise capital would provide a demutualization benefit to policyholders. A participation loan is an aggregated loan from multiple lenders to a single borrower.

If the insurer has a bad year who cares. Participating whole life policies Participating whole life policies share in the profits of the companys participating fund. Since you are not company owner with a non-par policy there is nothing to concern yourself with.

Life Insurance Needs Types Of Life Insurance Policies

Lic Jeevan Labh Plan Life Insurance Agent Life Insurance Marketing Life Insurance Facts

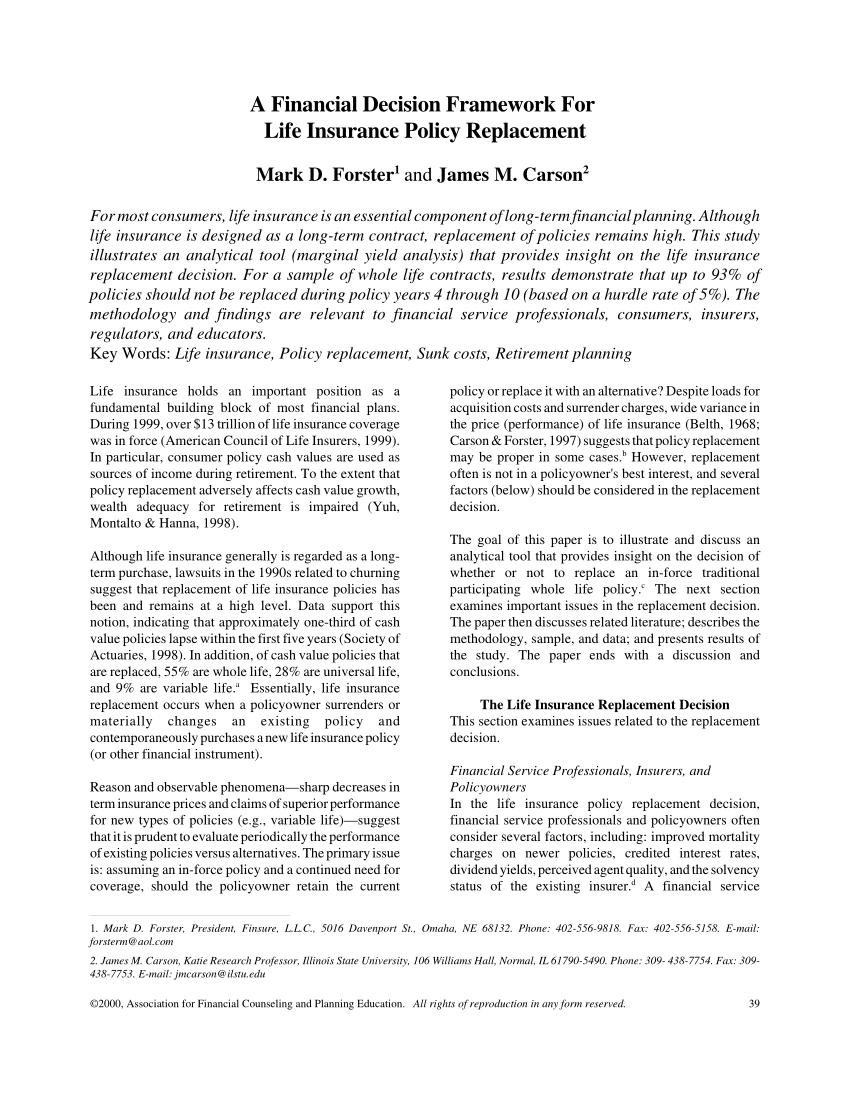

Pdf A Financial Decision Framework For Life Insurance Policy Replacement

Life Insurance Loans A Risky Way To Bank On Yourself

Life Insurance Introduction Of Life Insurance In Hk

Life Insurance Policies Whole Life Insurance Ppt Download

Paid Up Life Insurance Explained The Insurance Pro Blog

Pdf A Financial Decision Framework For Life Insurance Policy Replacement

Life Insurance Policy Loans Tax Rules And Risks

Understanding Whole Life Insurance Dividend Options

How To Choose Between Participating And Non Participating Whole Life Policies Axa Singapore

Life Insurance Needs Types Of Life Insurance Policies

Whole Life Insurance Check Compare Whole Life Insurance Online

Whole Life Insurance What You Need To Know White Coat Investor

Whole Life Insurance How It Works

Life Insurance Introduction Of Life Insurance In Hk

How Does Whole Life Insurance Work Costs Types Faqs

Post a Comment for "A Non Participating Whole Life Insurance Policy Was Surrendered"